Your Security

Protecting your personal information is our number one priority!

Fairfield County Bank recognizes your need for security. Whether it is on our website, within online or mobile banking, at an ATM, or while you are going about your daily life, we are Here For You!

We have received reports of a scam in which fraudsters are impersonating Fairfield County Bank employees and contacting clients to “verify” wire transfers.

In these calls, scammers may:

- Claim to be calling from Fairfield County Bank

- Ask for your mobile phone number

- Send a link asking you to authenticate or verify a wire transfer

This link is not associated with Fairfield County Bank and may prompt clients to enter online banking credentials.

Please remember:

- Fairfield County Bank will never ask for your online banking username or password

- Fairfield County Bank will never send links requesting authentication or account verification

Be cautious of unexpected calls, even if the phone number appears familiar or spoofed.

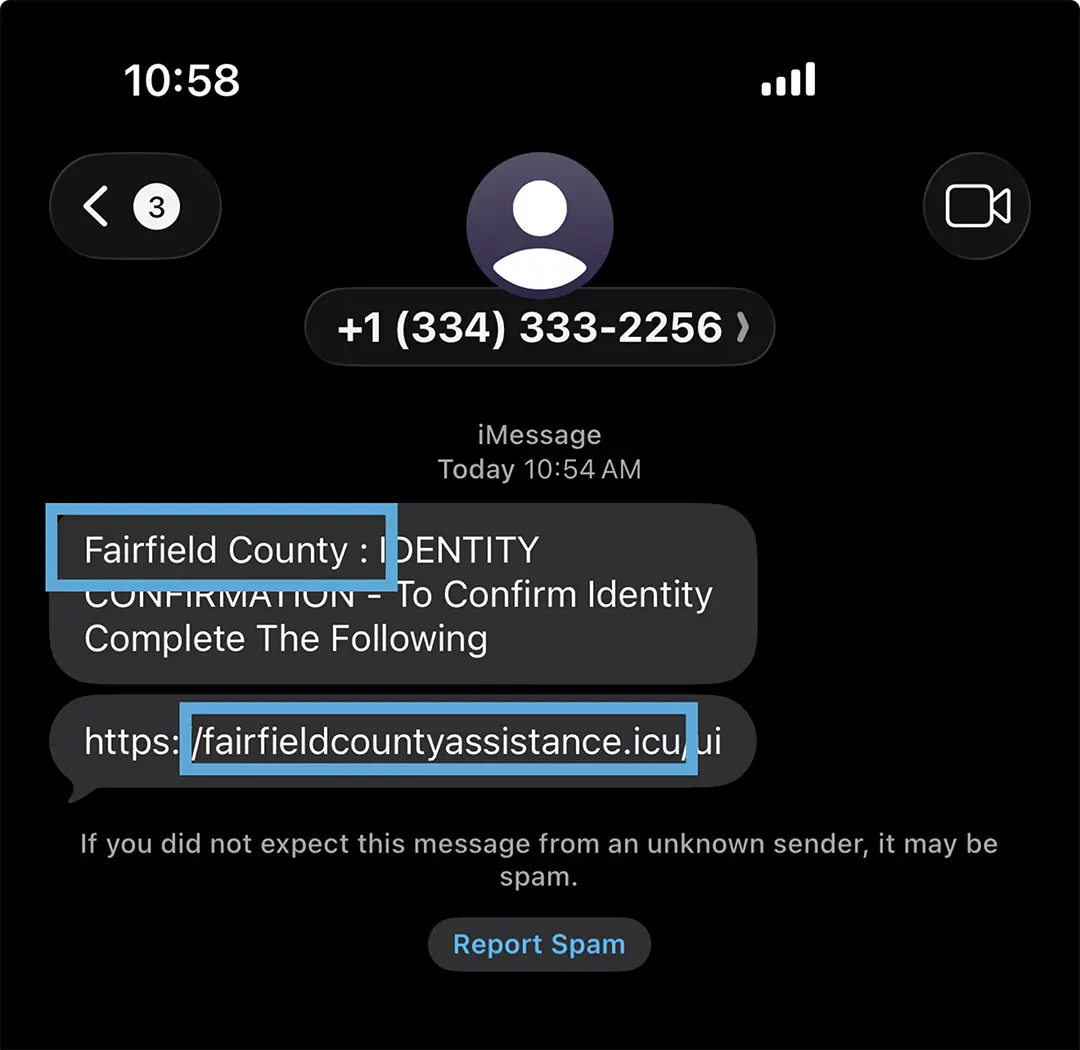

The message shown above is an example of a scam text message.

There are a few tell-tale signs that identify this as a scam:

- It claims to be from Fairfield County, not Fairfield County Bank

- The URL listed is not the Fairfield County Bank website

- The Sender's area code is not from Fairfield County

If you receive a suspicious call, text, or email:

- Do not click any links or provide information

- Hang up and/or report it as SPAM

- Contact your trusted Fairfield County Bank representative directly using a trusted phone number found on your debit card

Strong Passwords = Strong Protection

Strong passwords are your first line of defense against fraud and identity theft. Weak or reused passwords make it easier for scammers to access your accounts, stal personal information, and commit financial fraud.

- Use at least 12 characters

- Include a mix of uppercase, lowercase, numbers, and symbols

- Avoid personal details (birthdays, names, addresses)

- Don't reuse passwords across multiple accounts

- Enable multi-factor authentication (MFA)

- Update passwords immediately if you suspect suspicious activity

Fairfield County Bank will not contact you and ask for:

- Complete account numbers

- Complete Social Security Number

- Your debit card security codes

- Your debit card pin codes

- Passwords

If you have any concerns or doubts, remember: Stop, Evaluate, Talk to your banker.

Impersonation Scams:

Scammers pretend to be your bank, a government agency, or even a loved one in distress by "spoofing" their Caller ID information. These bad actors then use fear and urgency to pressure you into sending money or sharing sensitive information.

Warning signs:

- Demands for immediate action

- Requests for personally identifiable information (PII) like account numbers, Social Security Numbers, or PINs

- Familiar-looking caller ID that doesn’t feel right

Don’t Trust Caller ID Alone

It can be easily spoofed; always confirm the phone number.

Verify First

Hang up and call back using the official number from the organization’s website.

Don’t Send Money

Legitimate entities will never ask for payment via gift cards, cryptocurrency, or wire transfers.

Know Your Bank’s Policy

Fairfield County Bank will never call you to ask for:

- Bank account numbers, Social Security Numbers

- Debit card security numbers or PINs

- Online and mobile banking credentials or passwords

The Bank will never text a link to verify account information.

Practice Safe Checks

In coordination with the American Bankers Association, Fairfield County Bank is committed to educating our clients on the best way to stay secure, including practicing safe checks. It should come as easily as airline safety, so buckle up for this one. Learn More

Remote Desktop Scams

Remote access software has been used by scammers to gain access to personal information. Several apps such as AnyDesk, TeamViewer, and RemotePC, with legitimate purposes are exploited by scammers impersonating customer service representatives. Fairfield County Bank will never ask you to download a remote access software.

How does it work?

Scammers place calls disguised as a customer service representative and will try to tempt you to download an app, claiming there is an issue and the application is necessary to resolving the problem. They will oftentimes try to create a sense of urgency around an issue in order to pressure someone into installing the application. Once the software is downloaded and access has been granted, the fraudster can search for sensitive information, including online banking details.

Avoiding Remote Desktop Scams

- Never download a remote access software based on over-the-phone instruction

- If a representative asks you to download software to your phone or mobile device, hang up immediately

- Contact the service provider by using the phone number or contact method listed on their official website

- Never disclose passwords to a customer service representative.

Check Washing Fraud:

Check washing is a type of check fraud that occurs when a written check has been stolen and washed, oftentimes with common household chemicals, to remove the ink. The scammer can then change the check amount and payee.

Tips to Prevent Check Washing:

- When writing a check, use a black gel pen. Visit any Fairfield County Bank branch office if you need one

- Do not raise the red flag and place valuable mail in your box. The flag acts as an invitation for criminal attention

- Do not use free-standing USPS receptable boxes when mailing checks

- Mail checks by handing it directly to a USPS employee inside the Post Office

- Monitor your accounts frequently via online and mobile banking

- Use Bill Pay to send your payments.

- For business accounts, use Positive Pay

- Activate online alerts for cleared checks and specific check cleared

Protect Yourself by Detecting Fraud and Avoiding Scams

Review the actionable items provided in the documents below to stay informed and keep yourself safe from fraud.

- 5 Ways to Better Security

- Resources to stay protected, informed, aware, and alert

- Watch an online presentation on, “Keeping You Secure: How to Detect Fraud & Avoid a Scam”

Avoiding Phone Call Scams:

- Never give out your personal information via phone call, text, or email

- Emails and Phone Numbers can be spoofed or faked, so always make sure to check the sender or Caller ID carefully

- If you do not recognize the caller or the sender, do not respond or hang up immediately

If you are ever suspicious of a phone call, text or email claiming to be from Fairfield County Bank, you can report the incident by calling 203.431.7431.

For more information visit the Federal Communications Commission's page on Caller ID Spoofing here.

Tools You Can Use in Online and Mobile Banking

- Create and edit real-time text and email alerts

- Utilize the Debit Card Activation/Deactivation tool

- Make secure payments through bill pay

- View pending transactions

- Monitor your credit score

Use Money Manager 360 to put all your finances in one place. This is a great monitoring tool to use to ensure all your accounts activity is normal.

Learn more about Money Manager 360

Please call our Customer Care Center at 203.431.7431 with any questions or concerns you may have. Remember, we are always here to help you!

Can you pick out what is different?

- fairfielcountybank.com

- fairfieldcontybank.com

- fairfieldcountbank.com

- wwwfairfieldcountybank.com

When you go to use our website or receive an email from the Bank, be on the lookout for fake web (URL) and email addresses. Never click on a URL with a misspelling!

Tips and Tools to Keep You Safe

- Secured Socket Layer – SSL is an encryption method that we use to protect the information transmitted between our website and your computer.

- Electronic Mail - Our email form allows you to contact us safely by sending secure information through our form rather than through public email. The form is encrypted when it is sent over the Internet, which helps protect this information from being intercepted.

- Firewalls & Routers – We control and verify the data transmissions that gain access to our internal computer network through firewalls and routers.

- Multi-factor authentication

- Session time out

- Secure messaging

- Only the last four digits of your account number are visible

- One Time Passcode (OTP):

Starting in August, you may be presented with a One-Time Passcode when banking online or with your mobile device. A One-Time Passcode (OTP) is a heightened security feature that may be triggered when accessing your accounts. As an extra security measure, an OTP will be sent when using Zelle®.

The OTP will be sent via SMS (text message) to the mobile number on file. After entering the passcode, you will be able to access your account.OTP security works best when a mobile number is on file with the Bank, which is why it is important to confirm that we have a valid mobile phone number associated with your account as the primary number.

Verify that your mobile phone number is listed as the primary number through:

- Fairfield County Bank's online banking platform*

- Fairfield County Bank’s mobile banking app**

- By calling our Customer Care Center at 203.431.7431

- or by visiting a Fairfield County Bank Branch Office. You can find all locations and hours here.

* Once you've logged in to online banking, visit the "My Profile" section located in the Service Center*. Under the "My Profile" section, select "Change Phone Number" to review the phone numbers on file and update your primary number to your mobile phone number.

**In your Fairfield County Bank mobile app, select "Banking Services" and then "My Profile" from the menu options. Select "Change Phone Number" to review or update your primary number to your mobile phone.

Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

ATMs are one of the most convenient ways to bank. However, to criminals, they are just another way to try to steal your personal information.

Watch Dan Berta, President of Fairfield County Bank, explain how to prevent ATM fraud.

While the internet is a resourceful tool to find answers, stay up-to-date on news, shopping, and more, it is essential to take precautions to keep your identity safe.

Watch Dan Berta, President of Fairfield County Bank, provide tips on how to keep your identity safe while online.

The following articles contain information that can help you keep your identity protected.

- Creating a Cyber Secure Home

- Four Steps to Staying Secure

- FDIC Cybersecurity Guide for Financial Institution Customers

- Keep Your Email Safe from Web Scraping

- Avoiding Online Tax Scams

- Why Strong, Unique Passwords Matter

- Phishing Emails and You

- Traveling Securely

- Cybersecurity Information Sharing Act of 2015

- The Hidden Costs of a Data Breach

- FDIC Cybersecurity Guides for Business

- Top Tips for Internet Security at Work

- Going for Gold in Cybersecurity

While cybersecurity seems to get the majority of attention these days, it is just as necessary to mitigate the potential for identity theft offline.

- Never leave your purse or wallet in an unlocked car or unattended where its contents could be easily stolen.

- Never provide personally identifiable information, such as your social security number, over the phone or in the mail.

- Shred all documents that may contain sensitive personal information (social security numbers, bank account numbers, passport information, healthcare information, medical insurance, credit card and debit card numbers, and drivers license numbers)

- Properly discard of hard drives.

- Safely store personal information at home.

- Destroy credit cards and debit cards that are not in use.

Closely monitoring transactional activity on your bank and credit card accounts, checking your credit reports, and freezing or locking your credit are a few other steps you may want to consider to help protect yourself.

Considering freezing your credit? The Federal Trade Commission provides additional information at https://www.consumer.ftc.gov/articles/0497-credit-freeze-faqs.

To establish a credit freeze you will need to place it with the major credit bureaus listed below.

Equifax: https://www.freeze.equifax.com/Freeze/jsp/SFF_PersonalIDInfo.jsp or 1-800-349-9960

Experian: https://www.experian.com/freeze/center.html or 1-888-397-3742

TransUnion: https://www.transunion.com/credit-freeze/place-credit-freeze or 1-888-909-8872

Innovis: https://www.innovis.com/personal/securityFreeze or 1-800-540-2505

If you are not ready to place a freeze on your credit, you may want to consider a fraud alert. The Federal Trade Commission provides information about alerts here https://www.consumer.ftc.gov/articles/0275-place-fraud-alert.

Equifax Breach - The recent credit bureau breach potentially exposed hundreds of millions of consumers’ personally identifiable information. This sensitive information includes but is not limited to Social Security numbers, birth dates, addresses, driver’s license numbers, and credit card numbers.

Equifax’s website, www.equifaxsecurity2017.com is dedicated to helping you understand the breach and provides steps you may want to take to help protect your identity. Some of the suggested actions include:

- Checking to see if your personal information may have been exposed.

- Enrolling in Equifax’s free identity theft protection and credit monitoring. (The free enrollment period ends January 31, 2018.)